Net Revenue up 23%, with Strong Subscription-Based Revenue Growth

LAS VEGAS, November 14, 2023 — Healthy Extracts Inc. (OTCQB: HYEX), a platform for acquiring,

developing, patenting, marketing, and distributing plant-based nutraceuticals that target select high-

growth categories within the multibillion-dollar nutraceuticals market, reported results for the three and

nine months ended September 30, 2023. All comparisons are to the year-ago period unless otherwise

noted.

Financial & Operational Highlights

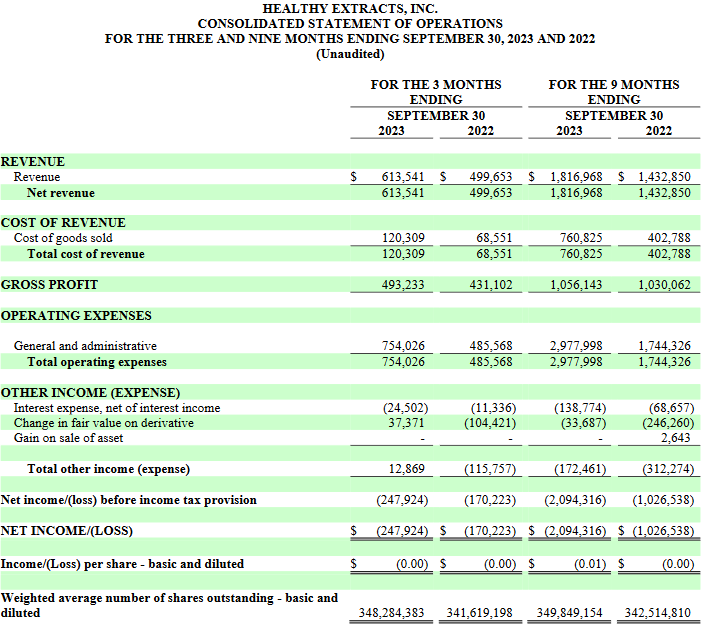

- Net revenue increased 23% to $614,000 in the third quarter of 2023 and was up 27% to $1.8 million for

the first nine months of 2023, driven by product line and distribution channel expansion, as well as

growth in subscription-based revenue. - Gross margin improved to 80.4% in the third quarter from 48.4% in the previous quarter due to a

favorable shift to higher margin sales. - Net loss in Q3 totaled $248,000 or $(0.00) per basic and diluted share, primarily due to one-time costs

associated with the company’s previously announced acquisition and related planned public offering

and uplist to a major exchange, interest expense, and stock-based compensation expense (comprised

of options and warrants). This compares to net loss of $170,000 or $(0.00) per basic and diluted share

in the same year-ago quarter. - Net income totaled $33,000 or $0.00 per share after excluding the costs associated with the company’s

planned acquisition and public offering expenses, regulatory expense, stock-based compensation

expense (comprised of options and warrants), the change in fair value on derivative expense, and

interest expense. - Direct-to-consumer subscription customers at September 30, 2023 increased 37% versus September

30, 2022, driving a 26% increase in subscription-based revenue for the first nine months of the year.

Amazon “Subscribe & Save” customers at September 30, 2023 increased 55% versus September 30,

2022, driving 25% increase in subscription-based revenue for the first nine months of the year.

Subscription growth is valuable since it helps reduce customer acquisition costs, increases traction, and

provides greater visibility into future revenue. - Officially launched BergametNA’s Sleep Breathing Support, a natural supplement designed to improve

sleep apnea and support more restful sleep, with strong initial sales.

Management Commentary

“In Q3, we continued to grow our top-line at a healthy double-digit pace as our product offerings,

customer subscriptions, and distribution channels continued to expand,” commented Healthy Extracts

president, Duke Pitts. “We also returned to normal margins of more than 80% due to improved

manufacturing efficiencies and lower freight costs implemented in Q2.

“The efficiencies implemented helped us generate profitability when excluding non-cash expenses and

certain one-time adjustments, such as those related to our previously announced planned acquisition and

related public offering expenses.

“Our expanded product offerings included the full official launch our BergametNA’s Sleep Breathing

Support, a natural supplement designed to improve sleep apnea by accentuating the ability of the brain to

communicate with the diaphragm and support more restful sleep. Given the better-than-anticipated initial

sales of this new product, it is on track to become one of our best sellers in 2024.

“Next up is our launch of LONGEVITY, a proprietary formulation designed to support arterial flexibility,

anti-aging, cellular and joint health. Its unique formulation is designed to boost blood flow and circulation,

slow the effects of aging, and reduce the deleterious effects of misplaced calcium in the body. We’re

currently on track to launch LONGEVITY before the end of the year.

“Our top brand ambassador and renowned fitness expert, Whitney Johns, is preparing to launch WHITNEY

JOHNS™ NUTRITION on-the-go gel packs for GUT HEALTH and COLLAGEN (anti-aging) in early 2024. They

are based on our exclusive Healthy Extracts delivery system and formulations.

“We also plan to soon introduce MYNUS sugar blocker, which is specially formulated to reduce up to 42%

of the sugar impact from meals. MYNUS is an on-the-go gel-pack which will be available under our

exclusive U.S. and Canadian licensing and manufacturing agreement with Gelteq featuring their advanced

gel technology. We plan to launch these new gel-packs in the first quarter of next year.

“We anticipate these new products will continue to help drive growth and market expansion as they

leverage our multiple sales and distribution channels and existing customer base. As with all of our

products, they will incorporate plant-based proprietary and patented ingredients supported by

independent published research.

“As we complete the year and prepare for 2024, we will continue to focus on expanding our recurring

revenue streams and growing our customer base, while maintaining our traditional gross margins. We will

continue to pursue strategic acquisitions that would further enhance our plant-based portfolio and build

upon the successful acquisitions of BergametNA™ for heart health and Ultimate Brain Nutrients™ for brain

health.

“We believe our strengthening results this year demonstrate we have built a solid platform for ongoing

growth and expanding our presence across the various markets we serve. We see this keeping us on pace

for another record year and providing favorable momentum going into 2024.”

Q3 Financial Summary

Net revenue in the third quarter of 2023 increased 23% to $614,000 from $500,000 in the same year-ago

quarter, primarily due to product line and distribution channel expansion.

Gross profit totaled $493,000 or 80.4% of net revenue as compared to $285,000 or 48.4% of net revenue

in the previous quarter and $431,000 or 86.3% of net revenue in the same year-ago quarter. The decrease

in gross margin compared to the year-ago period was a result of the increase in manufacturing and freight

costs which have subsequently normalized.

Operating expenses increased $268,000 to $754,000 compared to the same year-ago quarter. The

increase in operating expenses was due to the costs involved in the on-going efforts in the acquisitions

and planned public offering and uplist, and stock-based compensation expense (comprised of options and

warrants).

Net loss totaled $248,000 or $(0.00) per basic and diluted share compared to a net loss of $170,000 or

$(0.00) per basic and diluted share in the same year-ago quarter. The increased net loss was primarily due

to one-time costs associated with the company’s previously announced acquisition and related planned

public offering and uplist to a major exchange, increased manufacturing and freight costs, interest

expense, and stock-based compensation expense (comprised of options and warrants).

Excluding costs related to the company’s planned acquisition and public offering expenses, regulatory

expense, stock-based compensation expense (comprised of options and warrants), change in fair value on

derivative expense and interest expense, net income totaled $33,000.

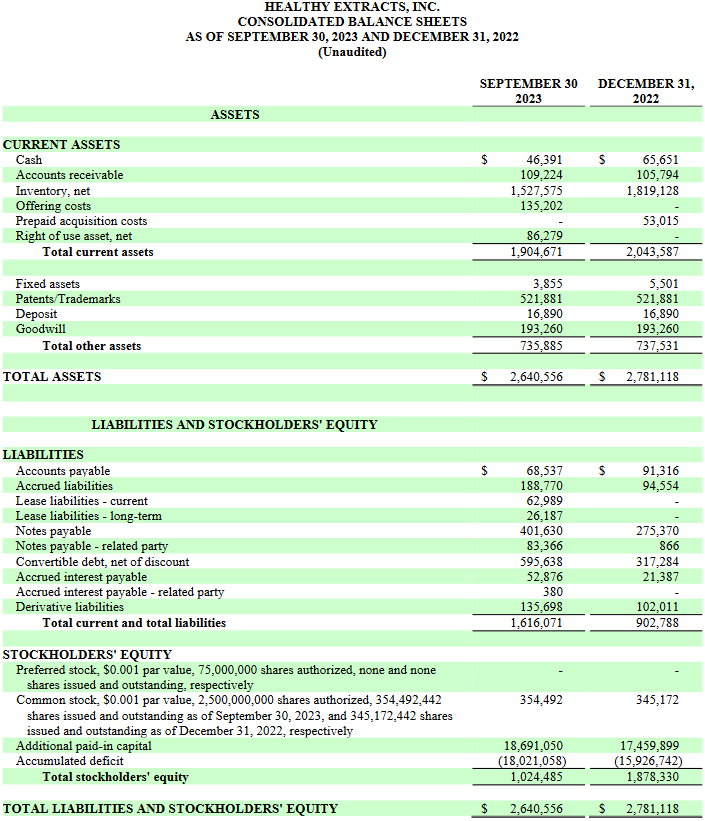

Cash totaled $46,000 as of September 30, 2023, compared to $92,500 on June 30, 20

First Nine Months 2023 Financial Summary

Net revenue in the first nine months of 2023 increased 27% to $1.8 million from $1.4 million in the same

year-ago period, primarily due to product line and distribution channel expansion.

Gross profit totaled $1.1 million or 58.1% of net revenue as compared to $1.0 million or 71.9% of net

revenue in the same year-ago period. The decrease in gross margin was a result of increased

manufacturing and freight costs during the earlier part of the year, with these factors improving in the

third quarter.

Operating expenses, excluding the costs involved in the on-going efforts in the acquisitions, planned public

offering and uplist to a major exchange and stock compensation expense, decreased $211,000 to $1.5

million compared to the same year-ago period. The decrease in operating expenses was due to a

reduction in general and administrative expenses.

Net loss totaled $2.1 million or $(0.01) per basic and diluted share, as compared to a net loss of $1.0

million or $(0.00) per basic and diluted share in the same year-ago period.

Excluding costs related to the company’s planned acquisition and public offering expenses, regulatory

expense, stock-based compensation expense (comprised of options and warrants), change in fair value on

derivative expense and interest expense, net loss in the first nine months of 2023 totaled $477,000 or

($0.00) per basic and diluted share.

About Healthy Extracts “Live Life Young Again”

Healthy Extracts Inc. is a platform for acquiring, developing, researching, patenting, marketing, and

distributing plant-based nutraceuticals

The company’s subsidiaries, BergametNA™ and Ultimate Brain Nutrients™ (UBN), offer nutraceutical

natural heart and brain health supplements. This includes the only heart health supplement distributed in

North America containing Citrus Bergamot SuperFruit™. This superfruit has the highest known

concentration of polyphenols and flavonoids

UBN’s KETONOMICS® proprietary formulations, which have been designed to enhance brain activity,

focus, headache and cognitive behavior, provide many sales and intellectual property licensing

opportunities.

For more information visit: healthyextractsinc.com, bergametna.com or tryubn.com.

Forward-Looking Statements and Safe Harbor Notice

All statements other than statements of historical facts included in this press release are “forward-looking

statements” (as defined in the Private Securities Litigation Reform Act of 1995). Such forward-looking

statements include our expectations and those statements that use forward-looking words such as

“projected,” “expect,” “possibility” and “anticipate.” The achievement or success of the matters covered

by such forward-looking statements involve significant risks, uncertainties and assumptions. Actual results

could differ materially from current projections or implied results. Investors should read the risk factors

set forth in the Company’s Annual Report on Form 10-K filed with the SEC on March 31, 2023, and future

periodic reports filed with the SEC. All of the Company’s forward-looking statements are expressly

qualified by all such risk factors and other cautionary statements. The Company cautions that statements

and assumptions made in this news release constitute forward-looking statements and make no

guarantee of future performance. Forward-looking statements are based on estimates and opinions of

management at the time statements are made. The information set forth herein speaks only as of the date

hereof. The Company and its management undertake no obligation to revise these statements following

the date of this news release.

Food and Drug Administration Disclosure

The product and formulation featured in this release is not for use by or sale to persons under the age of

12. This product should be used only as directed on the label. Consult with a physician before use if you

have a serious medical condition or use prescription medications. A doctor’s advice should be sought

before using this and any supplemental dietary product. These statements have not been evaluated by the

FDA. This product is not intended to diagnose, treat, cure or prevent any disease.

BergametNA™, Ultimate Brain Nutrients™, UBN™, Citrus Bergamot SuperFruit™ and F4T® are registered

trademarks of Healthy Extracts Inc.™

Company Contact

Duke Pitts, President

Healthy Extracts Inc.

Tel (720) 463-1004

Email contact

Investor Contact:

Ronald Both

CMA Investor Relations

Tel (949) 432-7566

Email contact

Media Contact:

Tim Randall

CMA Media Relations

Tel (949) 432-7572

Email contact